Insurance Industry Cyber Security Services

Intelligence Driven Cyber Security Operations

Insurance Industry Cyber Security Services

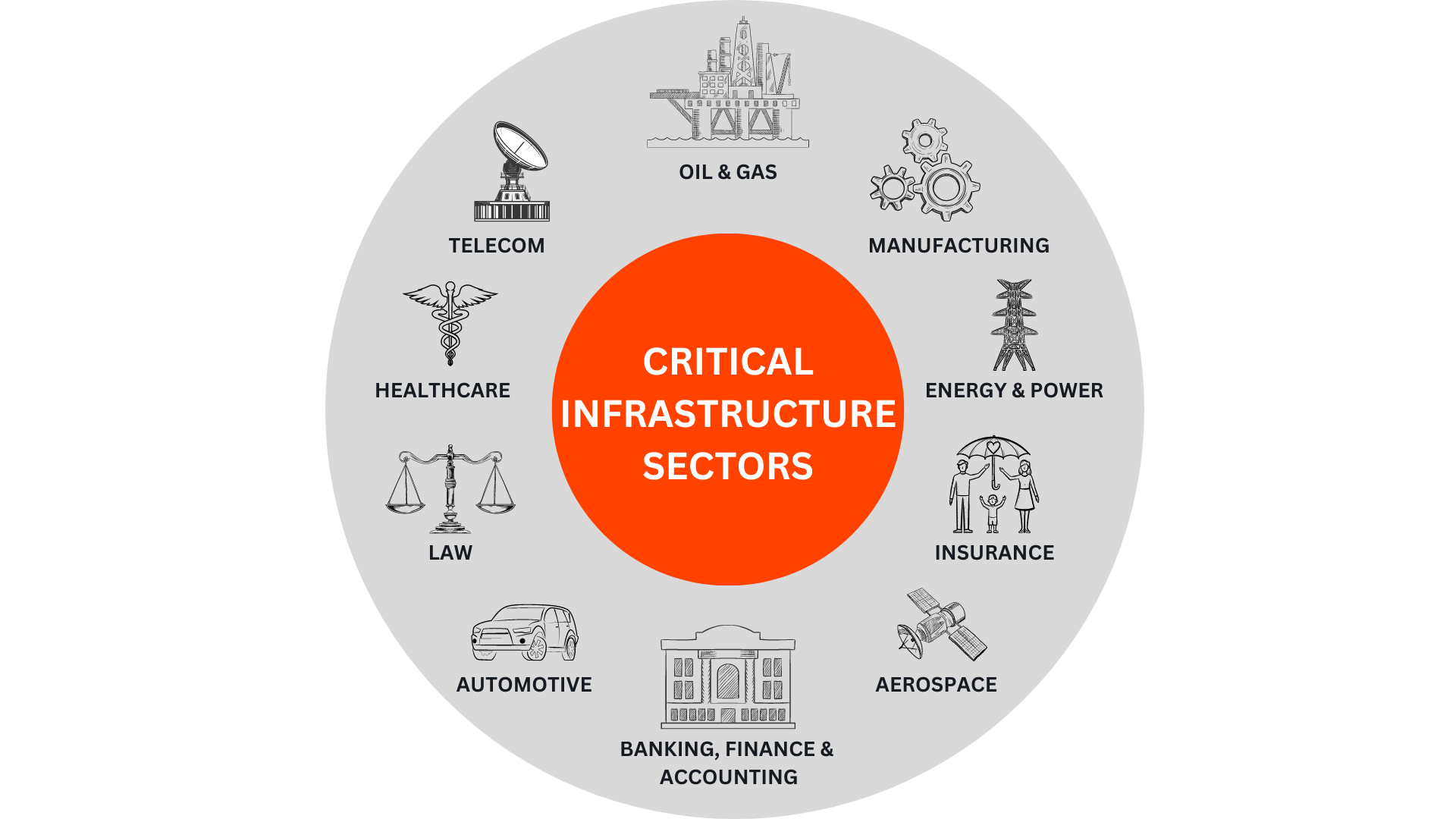

Insurance companies have become prime targets for cybercriminals due to the vast amount of personally identifiable information (PII) they store on their retail B2C policyholders. If hackers gain access to this sensitive data, they can exploit it for fraudulent activities, tracking policyholders, or damaging their reputations. Adding to the problem, insurance companies often prioritize cybersecurity low, leaving themselves exposed to potential attacks.

If your insurance company isn’t adequately safeguarding its PII, it’s time to consider enlisting the services of a professional cybersecurity firm like Certcube Labs. As India’s leading provider, Certcube Labs offers customized protection for your company’s data and infrastructure. In the event of a cyberattack, our team of experts can respond swiftly and mitigate any potential damage.

In today’s digital landscape, cybersecurity is of paramount importance. It can save your insurance firm from financial losses and reputational damage. Don’t wait until disaster strikes – take action now to secure your company. Contact Certcube Labs today!

Running a company like yours demands a significant amount of time and attention, leaving little room to focus on cybersecurity. But don’t worry; we’ve got you covered. We eliminate the need to hire inexperienced cybersecurity professionals by partnering with you and deploying cutting-edge technologies to detect, prevent, and respond to online threats. As India’s leading cybersecurity company with experience across various sectors, Certcube Labs is well-equipped to help your insurance firm withstand any cyberattack.

Our team of cybersecurity experts is here to assist your insurance firm in meeting all the compliance requirements mandated by regulators. From start to finish, our team will guide you through the process, ensuring that compliance is one of the least concerns for your insurance business.

Certcube Labs’ cybersecurity solutions are tailored to meet the compliance needs of insurance firms of all sizes. Contact us today for a non-binding consultation to see how we can help your insurance business enhance security and protect your customers and clients.

We will help you achieve compliance with regulations such as:

- PCI DSS: Your firm must comply with PCI DSS as it deals with sensitive cardholder data. Our cybersecurity expertise can assist you in establishing a robust cybersecurity protocol to meet PCI DSS criteria, ensuring the security of your customers and clients, whether they are purchasing a policy or making a premium payment.

- Sarbanes-Oxley: All insurance companies must adhere to Sarbanes-Oxley regulations to maintain their credibility and protect themselves from legal challenges. Our team possesses the knowledge and experience to help you comply with these intricate requirements while safeguarding your information.

- HIPAA/HITECH: Handling healthcare-related information, such as health policies and billing details, means it’s crucial to comply with HITECH regulations. We simplify the understanding and implementation of HIPAA/HITECH compliance measures, helping your business stay ahead of the curve.

- GDPR: All insurance firms handling data of European Union citizens must comply with GDPR.

Identifying the areas most vulnerable to hackers and implementing defense strategies is crucial to staying ahead of cyber threats. This includes evaluating your company’s infrastructure and weaknesses from both an attack and data security perspective. Once the vulnerabilities in your insurance company are identified, they can be strengthened.

Here are some common areas where your insurance firm may be targeted:

- Customer portals

- Cloud data storage

- Insider threats

- Content management platforms

- Credit card transactions

- Big data warehousing and applications

We understand that staying updated on ever-evolving cybersecurity threats is challenging. Our team can collaborate closely with you to thoroughly analyze your company’s cybersecurity vulnerabilities and help you find the best strategies for protection. Get in touch with Certcube Labs, a leading cybersecurity company with over 30 years of experience.

Hiring Certcube Labs ensures you have complete access to our cybersecurity expertise, resources, and services. We are committed to helping you achieve success, providing comprehensive cybersecurity services that safeguard your business from the latest threats.

Our team consists of industry experts with decades of experience and an unwavering commitment to delivering high-quality work. We utilize state-of-the-art technology and tools, guaranteeing that our efforts will protect your business against even the most sophisticated cyberattacks.

Securing your insurance business is an ongoing process, requiring dedicated attention and commitment. You can rely on us to be that dedicated partner, and we look forward to collaborating with you to secure your insurance business.

We understand that wasting time and money on ineffective protection plans that don’t align with your overall marketing strategy is not an option. That’s why we offer personalized consultation and guidance throughout the entire process, empowering you to make informed decisions about the best ways to protect your firm.

Ensure the Smooth Operation of Your Insurance Business with Our Security Solutions

Certcube Labs offers a wide range of cybersecurity services to help your insurance business combat cyberattacks. Fighting the most hostile hackers in the world is no easy task, but with us by your side, you can rest assured that your data and systems are safe.

These are just a few of the many cybersecurity services we offer. Check out our cybersecurity services pages for a detailed overview of our services. We are your friendly and knowledgeable cybersecurity experts and are here to help secure your insurance business against the latest threats.

We at Certcube Labs have certified pen testers who can help your company verify the security of its systems against external attacks. We use industry-standard tools to identify potential vulnerabilities and provide a report with recommendations for improvement.Our cyber professionals will help you comply with the necessary regulations of the insurance industry. We will work with you to create a data security policy that addresses your specific needs and threat landscape.

We will thoroughly analyze your company’s relationships with third-party vendors and help you assess the risks associated with those partnerships.We offer a range of solutions to help your business overcome the risks of online data storage. Our cyber experts will assist your firm in deploying secure and reliable cloud storage systems that meet your specific needs.Our experienced professionals will provide detailed reports describing the status of your security structure and highlighting any areas where improvement is needed.

This information can help you comply with regulatory mandates while protecting your business from future cyberattacks.We will assess your company’s applications and devise a comprehensive security plan that addresses the risks posed by those applications. Our experts can help you identify and fix vulnerabilities in your software, reduce the risk of data theft, and protect your systems from unauthorized access.

Stay Ahead of the Game by Understanding Your Opponent’s Mindset

Ransomware

This form of cyberattack can result in the complete lockdown of your company's systems. The attackers may only unlock them upon receiving a ransom, often demanding payment in cryptocurrencies like bitcoins. In some cases, malicious groups employ "kill switches" to permanently disable critical systems if the ransom demands are not met.

Social Engineering

This type of attack involves tricking employees at your insurance company into revealing confidential information, such as user passwords. Once the scammers obtain this information, they can exploit other system vulnerabilities or pilfer funds from your accounts.

Cloud Exploits

Insurance companies, like many others, rely on cloud-based applications for data storage and operational purposes. However, if these applications are not adequately patched and secured, they can become susceptible to cyberattacks. Once cybercriminals gain access to an insurer's cloud-based systems, they may launch a Denial of Service (DoS) attack, disrupting legitimate traffic and causing interruptions in premium processing.

Third Party Exploits

Insurance companies often rely on various third-party vendors to assist with their operations. If these companies are not properly vetted, they may be vulnerable to attacks that could lead to unauthorized access to your data or systems.

Our Fintech Insutry Cyber Security Services

CertCube Labs provides an extensive array of cybersecurity services tailored to empower your insurance business in its battle against cyberattacks. The task of defending against some of the most determined hackers in the world is indeed challenging, but with our expertise, you can have confidence that your data and systems remain secure.

These mentioned services are just a glimpse of our comprehensive cybersecurity offerings. For an in-depth understanding of our services, please explore our cybersecurity services pages. We take pride in being your trusted and well-informed cybersecurity partners, dedicated to fortifying your insurance business against the ever-evolving threats of the digital landscape.

Data Security & Compliance

Our team of cybersecurity experts is dedicated to aiding your compliance with the essential regulations of the insurance industry. We collaborate closely with you to craft a data security policy that is finely tuned to address your unique requirements and the evolving threat landscape.

Penetration Testing

At CertCube Labs, we boast a team of certified penetration testers ready to assist your company in verifying the security of its systems against external attacks. Leveraging industry-standard tools, we meticulously uncover potential vulnerabilities and furnish you with a comprehensive report containing actionable recommendations for enhancing your security posture.

Application Security

We will evaluate your company’s applications and formulate a comprehensive security plan specifically tailored to address the risks associated with those applications. Our experts excel at identifying and remedying vulnerabilities in your software, reducing the likelihood of data breaches, and safeguarding your systems from unauthorized access.

Third-Party Risk Assessment

We will conduct a comprehensive analysis of your company’s relationships with third-party vendors and assist you in assessing the associated risks inherent in these partnerships.

Cloud Security Solutions

We provide a variety of solutions designed to help your business mitigate the risks associated with online data storage. Our team of cyber experts will guide your firm in the implementation of secure and dependable cloud storage systems tailored to your precise requirements.

Tailored reporting for compliance

Our seasoned professionals will furnish you with comprehensive reports outlining the status of your security infrastructure, pinpointing areas where enhancements are warranted. This valuable information not only aids in regulatory compliance but also fortifies your business against potential future cyberattacks.

Frequently Asked Questions

Why is cybersecurity important for the insurance industry?

Cybersecurity is essential in the insurance industry to protect sensitive customer data, maintain trust, and comply with regulatory requirements. It also safeguards against financial losses due to cyberattacks.

What are the most common cyber threats faced by insurance companies?

Common threats include data breaches, ransomware attacks, social engineering, and insider threats. These can result in significant financial losses and damage to reputation.

What role does threat intelligence play in insurance industry cybersecurity?

Threat intelligence helps insurance companies stay informed about emerging threats and vulnerabilities, enabling them to proactively defend against cyberattacks.

How can insurance companies protect against ransomware attacks?

Protection measures include robust endpoint security, regular backups, employee training, and a well-defined incident response plan to recover data without paying ransoms.

What is the impact of a data breach on insurance companies, and how can it be mitigated?

A data breach can result in financial losses, legal actions, and damage to reputation. Mitigation involves swift detection and containment, notifying affected parties, and offering identity theft protection services.

How can insurance companies ensure third-party vendors maintain adequate cybersecurity standards?

Insurance companies should conduct thorough security assessments of third-party vendors, require them to adhere to cybersecurity standards, and include security clauses in contracts.