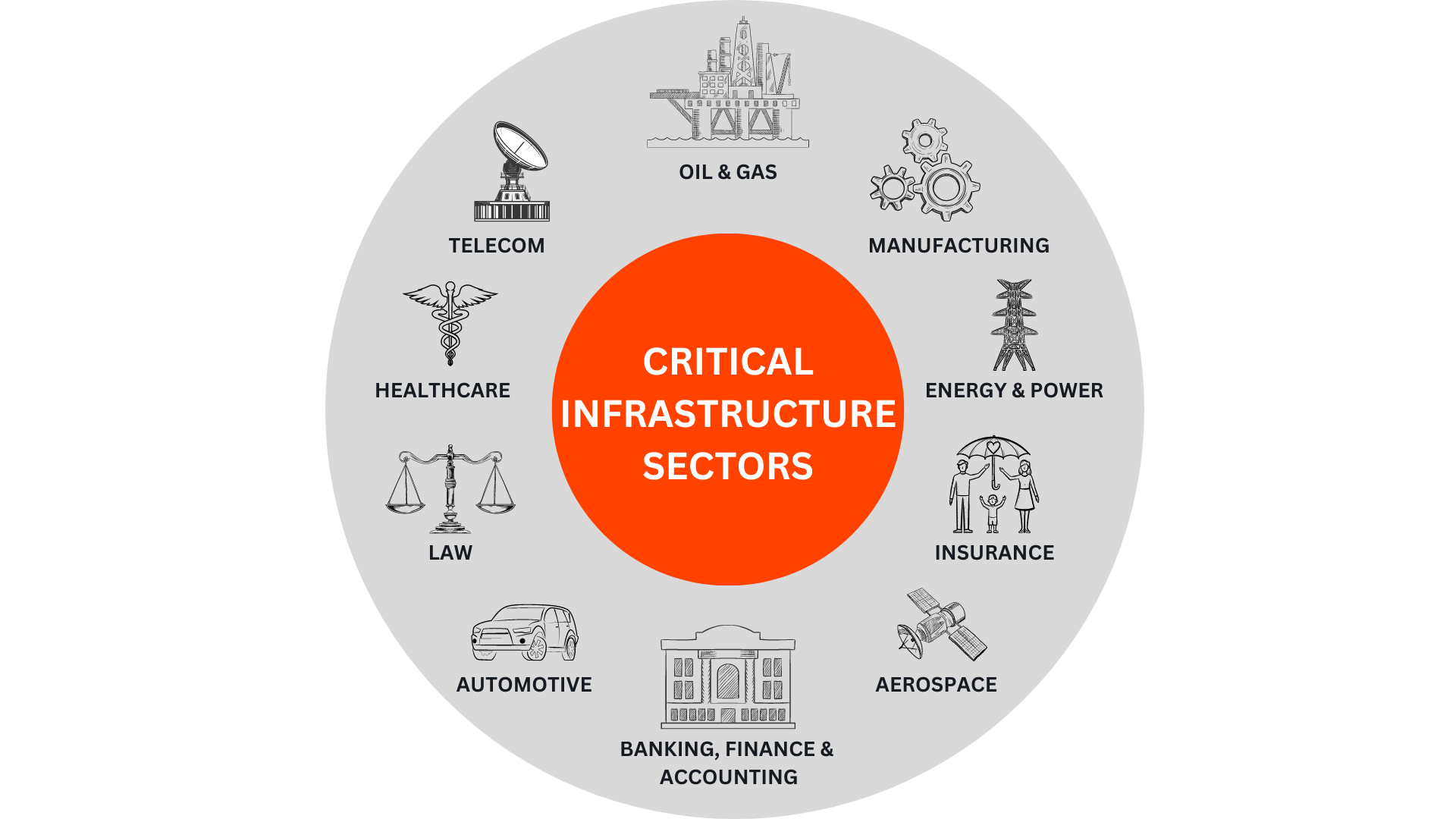

Finance Sector Cyber Security Services

Intelligence Driven Cyber Security Operations

Why Finance Sector Cyber Security is Required ?

The digital transformation of financial services has significantly amplified the exposure to cybersecurity threats and vulnerabilities. With the evolution of hackers’ strategies, identifying and mitigating cyber risks within the financial sector has become increasingly complex.

Given that a substantial portion of financial institutions heavily rely on big data for their routine operations, they emerge as prime targets for malicious online actors. Financial service providers amass and retain personally identifiable information (PII) belonging to their clientele, encompassing critical data like contact details, banking information, income particulars, and residential addresses.

Consequently, cybercriminals gaining unauthorized access to such sensitive information can exploit it for malicious activities, often involving financial fraud for personal gain. This escalating risk landscape underscores the importance of robust cybersecurity measures.

CertCube Labs stands as a dependable partner in safeguarding finance-based organizations from these threats. Our comprehensive suite of cybersecurity solutions is meticulously crafted to address the evolving tactics of cyber adversaries. By harnessing advanced technologies, CertCube Labs empowers financial entities to preserve the integrity of their information, resources, and customer trust.

Through proactive vulnerability assessments, vigilant monitoring, and incident response support, CertCube Labs ensures that financial institutions can navigate the intricate realm of cybersecurity with confidence. By bolstering the security posture of finance-related organizations, we contribute to maintaining the stability and trustworthiness of the financial sector in the face of evolving cyber challenges.

Prominent techniques employed by cyber attackers in the financial sector encompass:

- Data breaches

- Ransomware attacks

- Hacking incidents

- Malware intrusions

- Threats from insiders and third parties

- Exploitation of social engineering and human errors

While financial sector cybersecurity breaches can indeed lead to financial losses, their repercussions extend to tarnishing the reputations of financial service providers as well.

Recognizing the paramount importance of information technology security in the financial realm, CertCube Labs offers tailored financial sector cybersecurity services that yield the following advantages:

- Comprehensive visibility into your organization’s critical systems, networks, and data

- Rapid and informed response to emerging threats by our proficient infosec teams

- Deployment of robust cybersecurity tools from CertCube Labs to ensure the safeguarding of valuable information

- Mitigation of potential penalties and avoidance of legal repercussions through cybersecurity compliance

- Maintenance of high financial data security standards, thereby minimizing the need for frequent cybersecurity assessments and audits

With CertCube Labs as your cybersecurity partner, your financial organization gains the assurance of fortified defenses, meticulous compliance, and optimized cybersecurity operations. By leveraging our expertise, financial institutions can focus on their core functions with the peace of mind that their information and operations are steadfastly protected.

Financial Cybersecurity Regulations

Given the stringent regulations governing the financial sector, businesses within this industry must adhere to rigorous standards to guarantee legal compliance. When it comes to evaluating cybersecurity compliance in the financial domain, CertCube Labs’ cybersecurity specialists are suitably equipped. Following thorough consultations on cybersecurity within the financial sector, we will leverage our proficiency to benefit your enterprise. Our focus is on aiding you in fulfilling the prerequisites outlined in cybersecurity regulations specific to banking and finance.

Financial Cybersecurity Solutions

Financial cybersecurity is of paramount importance in today’s digital landscape, where the financial sector is an attractive target for cybercriminals seeking monetary gain, sensitive information, and disruption. To mitigate these risks and protect both financial institutions and their clients, robust financial cybersecurity solutions are essential.

Here are some key aspects and solutions within financial cybersecurity:

Access Management Security

Many financial industry regulations prioritize safeguarding sensitive customer data, as cyber breaches, including ransomware attacks, often stem from unauthorized data access and exploitation by malicious actors.

We enhance data protection through an access management strategy, incorporating:

Privileged Access Management (PAM): PAM solutions oversee privileged accounts and monitor critical asset access, automating alerts for events like password changes and multiple failed login attempts. They also facilitate insider threat and behavioral monitoring, reducing the risk of internal breaches.

Zero-Trust Network Access (ZTNA): ZTNA is an evolution of the Zero-Trust Architecture (ZTA) philosophy, inherently distrusting all network activity and mandating user identity verification. ZTNA governs LAN access, permitting entry solely to authenticated users.

Threat Detection and Response

In the financial sector, the adage “time is money” holds true, especially in the context of cyberattacks. The longer an attacker remains undetected within your systems, the more harm they can inflict. Microminder employs advanced threat intelligence and hunting technologies to ensure cybersecurity compliance and swift threat identification and response, encompassing:

Security Information and Event Management and Security Orchestration, Automation, and Response (SIEM and SOAR): These solutions aggregate and analyze data from logs and alerts, pinpointing potential security incidents for immediate action.

Managed Detection and Response (MDR): Microminder’s MDR services provide financial service providers with continuous network monitoring. MDR cybersecurity solutions empower you to promptly detect, investigate, and respond to threats within your organization, bolstering your overall security posture.

Endpoint Defense Systems

Endpoint security is a critical concern in the financial sector, particularly with remote workers accessing data beyond the internal network perimeter. These external endpoints can serve as entry points for malware, potentially granting cyber attackers access to sensitive corporate data. Microminder offers solutions to fortify your endpoint security, including:

Extended Detection and Response (XDR): XDR extends beyond standard endpoint detection and response (EDR), enhancing the ability to combat sophisticated malware attacks. It employs behavioral analysis and machine learning (ML) to enhance and streamline threat detection and security data correlation.

Secure Web Gateways (SWGs): SWGs act as gatekeepers, blocking access to websites that present security threats or contain malicious content. They meticulously inspect websites, evaluating content based on risk levels and predefined security policies. SWGs can block data transmission, filter hazardous content, or alert users to potentially harmful material, thereby enhancing web-based security.

IT Infrastructure Security

Much like other industries, the financial sector has shifted from on-site work to remote work practices, leading to a heightened reliance on cloud-based computing and infrastructure (IaaS). This shift has exposed cybersecurity vulnerabilities, as traditional perimeter-focused defenses are no longer sufficient.

We assist your organization in embracing modern, robust solutions to secure cloud-hosted SaaS applications, including:

Firewall as a Service (FWaaS): FWaaS functions similarly to a Next-Generation Firewall (NGFW), filtering traffic between your organization’s network and the internet. Our cloud-security experts conduct a thorough assessment of your current firewalls and then deploy an agile FWaaS within your cloud infrastructure, ensuring the security of critical financial data.

Software-Defined Wide-Area-Networking (SD-WAN) Security Solutions: These solutions leverage Next-Generation Firewalls (NGFWs) to deliver comprehensive protection against online threats. Our approach prioritizes prevention over threat detection and response, incorporating threat intelligence solutions to enhance security.