Fintech Industry Cyber Security

Intelligence Driven Cyber Security Operations

Why Fintech Industry Cyber Security is Important

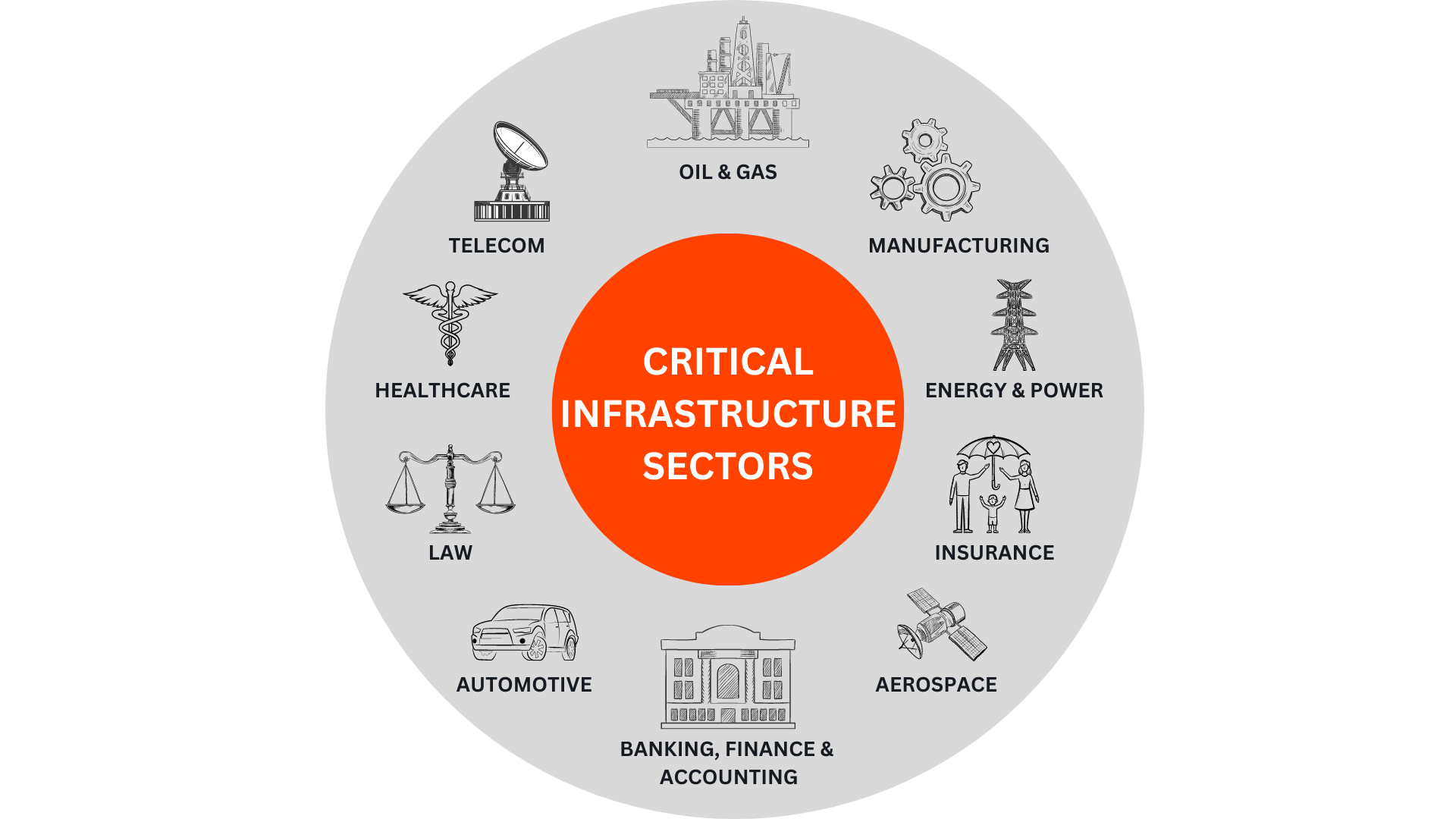

According to the Cyber Security Breaches Survey, more than 40% of businesses face annual cyberattacks, underscoring the critical need for comprehensive cybersecurity in an increasingly digital world. Fintech companies, handling sensitive data, are particularly susceptible. Fintech firms are deeply involved in electronic payments, mobile transfers, cryptocurrency trading, and end-to-end user platforms, enhancing efficiency but also elevating security risks. Therefore, robust cybersecurity measures are imperative to safeguard user data against theft and malicious attacks.

As the FinTech sector expands, so does the cybersecurity industry, catering to the evolving needs of FinTechs. Innovations like Artificial Intelligence and Machine Learning have become standard in fintech cybersecurity, bolstering consumer trust. Subsectors like Blockchain and RegTech are emerging as robust tools in securing FinTech data.For fintech leaders, the ongoing technological revolution in financial services is evident. Fintech disrupts banking, payments, asset management, and insurance, with digital transformation exposing vast amounts of data and new security challenges. Safeguarding confidential information, including personal and financial data, is paramount for continued success.Fintech cyberattacks extend beyond financial implications, impacting compliance standards and eroding customer trust. Fintech services carry the responsibility of safeguarding both customer data and finances, making them prime targets for attackers seeking financial gain.

According to an IBM research report, financial service providers have been the primary targets of cybercriminals for three consecutive years, underscoring the critical importance of robust financial cybersecurity measures.

Although fintech firms may not be subject to as stringent regulations as traditional banks, they must prioritize their security. Proactive cybersecurity services like penetration testing (pentesting) offer fintech businesses a valuable means to mitigate digital risks.

The fintech sector is a prime target for cyberattacks, drawing cybercriminals seeking to breach systems and steal sensitive data, including credit card information. These attacks encompass various vectors, such as identity theft, phishing, malware, and ransomware.

Given these factors, it’s imperative for companies to establish robust risk management policies. Let’s delve into the core benefits of fintech cybersecurity:

1. Compliance: Fintech firms often begin their application security journey with compliance requirements, emphasizing the importance of reducing cybersecurity risk. Compliance frameworks like GDPR or PCI DSS are vital, and financial institutions, in particular, must adhere to rigorous regulations. For instance, PCI DSS mandates intrusion detection systems to prevent breaches.

2. Fintech Data Protection: Beyond PCI DSS, regulations like the Gramm-Leach-Bliley Act (GLBA) require stringent data security standards for financial information. Protecting vast amounts of sensitive data is critical, and deploying security measures such as firewalls is paramount.

3. Reputation: Financial institutions bear the responsibility of safeguarding their reputation, as a cyberattack jeopardizing customer data or financial assets can be disastrous. Establishing and maintaining customer trust hinges on data and financial security. Implementing pentesting into the software development lifecycle (SSDLC) becomes essential to fortify fintech apps and projects, fostering trust.

In today’s digital landscape, data breaches pose risks to all industries, making robust security testing imperative. Protect your fintech solution against cybersecurity threats with CertCube Labs by your side.

Resolve Fintech Security Concerns with US

“Cybersecurity can be a time-consuming and challenging endeavor, especially for fintech companies. CertCube Labs understands the delicate balance between running your business and safeguarding your data. That’s why we offer a comprehensive solution that takes care of everything for you. Our network security experts analyze and detect potential vulnerabilities in your network architecture, taking proactive measures. If an attack occurs, our team is prepared to respond swiftly and decisively. With CertCube Labs, you can:

- Protect Financial and Personal Data

- Prevent Unsafe Coding Practices

- Integrate Cybersecurity and Data Sharing

- Resolve Data Ownership Issues

- Detect and Respond to Malware

- Meet Regulatory Obligations

CertCube Labs is your one-stop shop for all your cybersecurity needs. Contact us today to discover more about our services and how we can help fortify your company against cyber threats.

The cybersecurity landscape for fintech firms is ever-changing, with new technologies and tactics emerging regularly. Having an ongoing, tailored cybersecurity service is crucial. CertCube Labs is not your average cybersecurity provider. We are passionate about what we do, making your security our top priority. With over three decades of cybersecurity expertise, we are uniquely positioned to deliver a comprehensive, customized solution. Our track record with some of the UK’s largest fintech companies demonstrates our ability to protect your business.

We continually update our technology to stay ahead of evolving threats, ensuring the highest standards of data security. With our skilled team, your fintech company is in capable hands. Contact CertCube Labs today to embark on your cybersecurity journey!”

Avoid Becoming the Next Fintech Cyberattack Victim

Cybercriminals often target fintech firms due to their comparatively lower investments in cybersecurity compared to banks. These malicious actors can infiltrate a company’s computers discreetly, encrypting all data and demanding ransom, often in bitcoin, for data release.

At CertCube Labs, we recognize the gravity of data breaches and boast a seasoned team with years of experience safeguarding companies from cyber threats. Our holistic cybersecurity solutions revolve around three crucial pillars: detection, prevention, and response.

Enhance Fintech App Security with Our Innovative Solutions

Data Encryption

Our advanced encryption techniques ensure the security of your data. Even if unauthorized access occurs, any information within your app remains unreadable and unalterable.

Role-Based Access Control

We assist in establishing a role-based access control system, granting access exclusively to authorized individuals. Rest assured that your data remains confidential and tamper-free, safeguarded from unauthorized access.

Infrastructural Security

Our dedicated team of professionals operates 24/7 to fortify your infrastructure against potential intrusions. Employing top-tier security features like firewalls and intrusion detection systems, we ensure the continuous safety of your data.

Secure Authentication Technologies

We utilize the OTP System, Login Sessions Time, and adaptive authentication to enhance the security of your financial application, guarding against both internal and external security threats.

Our Fintech Industry Cyber Security Services

Fintech companies like yours have revolutionized the financial services sector, but it’s crucial to ensure your organization is taking the essential precautions to shield itself from today’s evolving cyber threats. Given that fintech deals directly with sensitive financial data, strengthening your cybersecurity infrastructure is paramount in safeguarding your operations from both internal and external cyber risks.

While fundamental data security measures like password protection, malware scans, network device monitoring, and advanced intrusion detection systems are central to any cybersecurity strategy, they may not suffice against more sophisticated cyberattacks. Consequently, we offer an array of tailor-made cybersecurity solutions specifically designed for financial institutions such as yours:

CISO Compliance as a service

By enlisting the expertise of our professionals, you can be certain that your information security and data protection management aligns with all applicable regulations.

Penetration Testing

We offer penetration testing services to the industry, employing simulated real-life techniques to thoroughly assess the security of your applications and systems.

PCI DSS, GDPR, and ISO 27001 Compliance

Our dedicated team of cybersecurity professionals goes above and beyond to offer comprehensive guidance and unwavering support, ensuring your organization not only meets but fully complies with these crucial regulations.

Third-Party Risk Assessment

Our team of experts is capable of conducting an extensive risk assessment to evaluate the security status of your business partnerships and associations.

Cloud Security Solutions

CertCube Labs develops a security strategy for your cloud-based services and products, encompassing protective measures and business continuity plans.

Vulnerability Assessments

We conduct security reviews and vulnerability assessments to pinpoint potential risks and weaknesses within your systems.