Banking Industry Cyber Security Solutions

Intelligence Driven Cyber Security Operations

Banking Industry Cyber Security

In the banking sector, customer transaction behaviors are undergoing a noticeable shift, with a rapid surge in the adoption of digital channels like internet banking, digital wallets, mobile banking, and ATMs. While this evolution enhances convenience, it also heightens the vulnerability to cyberattacks, leading to potential financial losses and damage to reputation. This could erode customer trust, further magnifying the consequences.

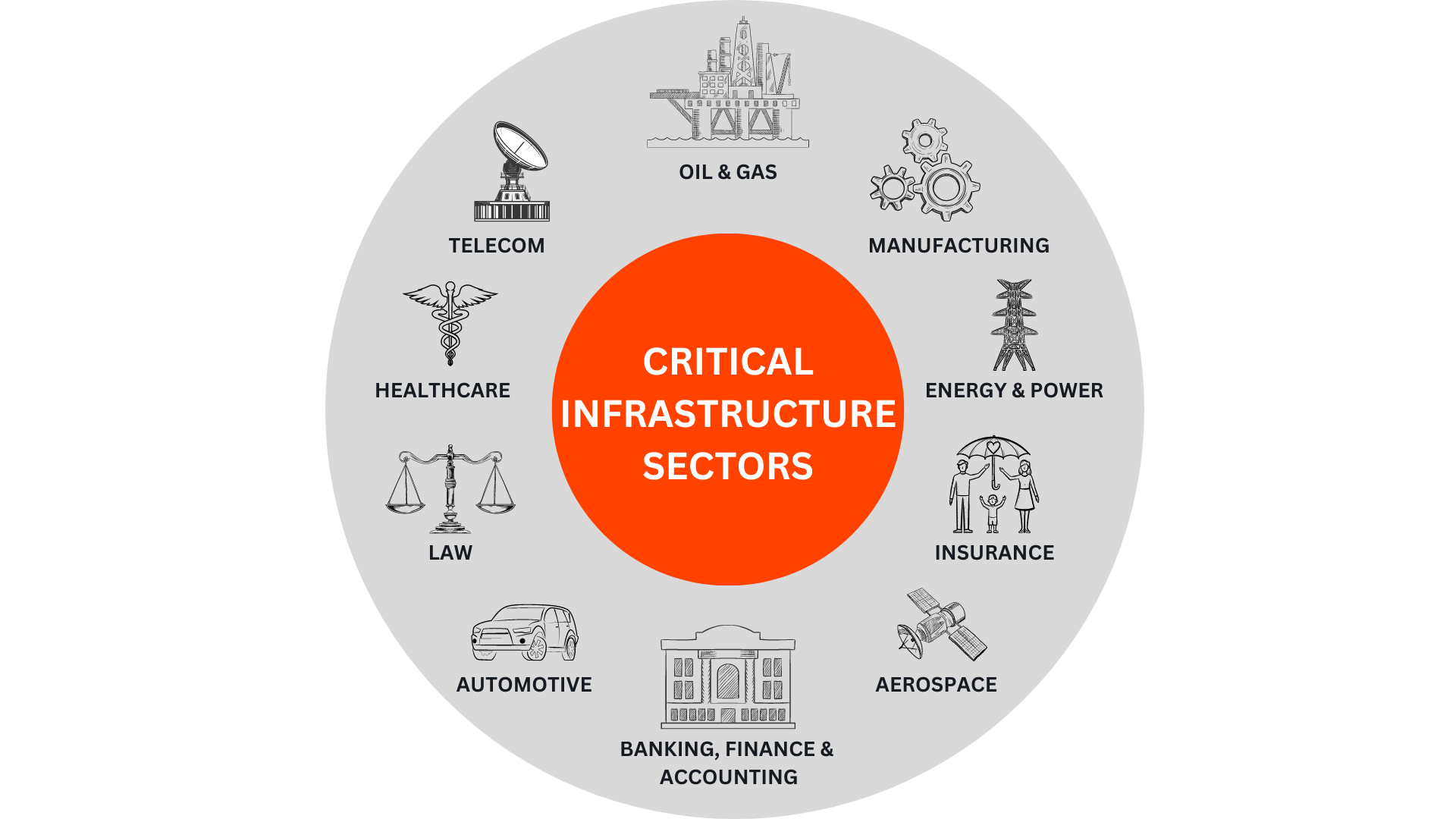

Several key factors necessitate significant security investments by banks:

- Escalating incidents of financial data breaches, encompassing card data and personal identifiable information.

- Unauthorized access to the bank’s networks and systems.

- Evolving customer expectations, technology capabilities, demographics, and regulations driving transformation in the banking landscape. Hence, a proactive security approach becomes crucial.

Given the mounting cyber threats, banks are grappling with unprecedented challenges concerning data breaches. Strengthening cybersecurity is vital, and certain trends stand out:

- The financial sector faces nearly three times more cyberattacks compared to other industries.

- Data breaches (both internal fraud and external cybercriminal activity) result in significant cost escalation.

- Projections indicate a 40% increase in cyber security infrastructure expenses by 2025.

- Biometrics and tokenization are gaining traction as not only payment solutions but also as tools for safeguarding sensitive data.

- Customers are embracing biometrics for authentication in mobile banking, ATM transactions, and payments.

- As digital channels dominate banking services, enhanced authentication and access controls are essential for maintaining security while preserving a positive customer experience.

With rapid technological advancements shaping the banking landscape, including unmanned aerial systems, the Internet of Things (IoT), Near Field Communication (NFC), and wearable devices, future considerations must include these elements.Upcoming priorities for banks include cloud-based platforms, robotic process automation, and cognitive technologies. While automation enhances security efficiency, it necessitates robust governance and control mechanism .These trends and challenges align with the expertise provided by CertCube Labs. Our comprehensive security solutions can assist banks in navigating these dynamic shifts and bolstering their cybersecurity measures effectively.

In the banking sector, relegating cybersecurity to a secondary concern is ill-advised. Neglecting the implementation of a robust cybersecurity solution can result in the following ramifications:

- Customer Loss: Should a cyberattack occur, the primary casualties would be the bank’s customers. The process of recovering pilfered funds can be intricate and protracted, causing anxiety and eroding trust in the bank.

- Reputation Damage: A cyberattack’s impact can reverberate across your bank’s reputation. This vulnerability could be exploited by external entities and the media, branding your bank as inadequately fortified against cyber threats. This erosion of consumer confidence might impede customer acquisition and mar your reputation.

- Sensitive Data Compromise: Theft of data is a critical concern for banks in the face of a successful hacker breach. This stolen information can encompass account numbers, birthdates, and other sensitive personal details. If these particulars fall into the hands of criminals or terrorist groups, safeguarding them from misuse becomes an arduous challenge.

CertCube Labs is steadfast in its commitment to fortifying your cybersecurity posture, recognizing that overlooking these risks could lead to customer losses, reputation damage, and compromised sensitive data.

As per IBM’s 2021 Cost of a Data Breach Report, the financial sector encounters data breaches with the second-highest associated costs, trailing only behind the healthcare sector. The financial industry is also featured in the top five sectors for security incidents in 2021, according to Verizon’s Data Breach Investigation Report (DBIR). The presence of valuable data, susceptible to misuse in fraud and cyberattacks, renders the financial industry a prime target for costly and damaging data breaches.

However, data breaches are not the sole risk that banks contend with. They are perpetually confronted by ransomware infections, phishing campaigns, and account takeover attacks. These threats can culminate in data breaches, operational disruptions, and substantial remediation expenses.

Prominent cyber threats commonly faced by banks include:

- Phishing: Phishing attacks entail deceptive messages designed to manipulate recipients into accessing malicious websites or opening infected attachments. This tactic is a primary vehicle for delivering malware and stealing crucial login credentials and sensitive data.

- Distributed Denial of Service (DDoS): DDoS attacks involve a multitude of infected computers bombarding an organization’s systems with spam requests. The ensuing overwhelming of these systems renders them unresponsive to legitimate requests. DDoS attacks might aim to disrupt operations or even function as extortion tools.

- Vulnerability Exploitation: Cyber threat actors systematically scan organizations’ publicly accessible applications to identify exploitable vulnerabilities. These vulnerabilities can range in impact from executing malicious code to pilfering sensitive data or conducting Denial of Service (DoS) attacks against a bank’s systems.

- Account Takeover: The surge in remote work practices has driven the widespread adoption of secure remote access solutions. Attackers exploit leaked, pilfered, or guessed credentials to gain unauthorized access to corporate systems, facilitating data theft or malware deployment.

An array of cyberattacks are engineered to deliver malware to an organization’s systems. Common malware threats encountered by banks include:

- Ransomware: Ransomware assaults disrupt banking operations and potentially result in the permanent loss of valuable data. In recent times, ransomware groups have broadened their tactics to encompass information theft and breach. This escalation could expose customers’ financial data on the dark web, leading to regulatory penalties for banks.

- Cryptominers: Cryptomining malware infiltrates an organization’s devices and exploits their computational resources to perform resource-intensive operations, benefiting the attacker.

- Infostealers: Given the sensitive nature of financial data held by institutions, infostealer malware targets and exfiltrates this valuable information, triggering data breaches and subsequent regulatory repercussions.

- Botnets: Botnet malware aims to infiltrate and commandeer target computers. Once compromised, the attacker wields remote control over the infected systems, utilizing them for DDoS or credential stuffing attacks.

CertCube Labs expertise is particularly pertinent in addressing these challenges. Their specialized security solutions can assist banks in navigating this complex landscape, bolstering cybersecurity measures and ensuring the safety of critical financial data.

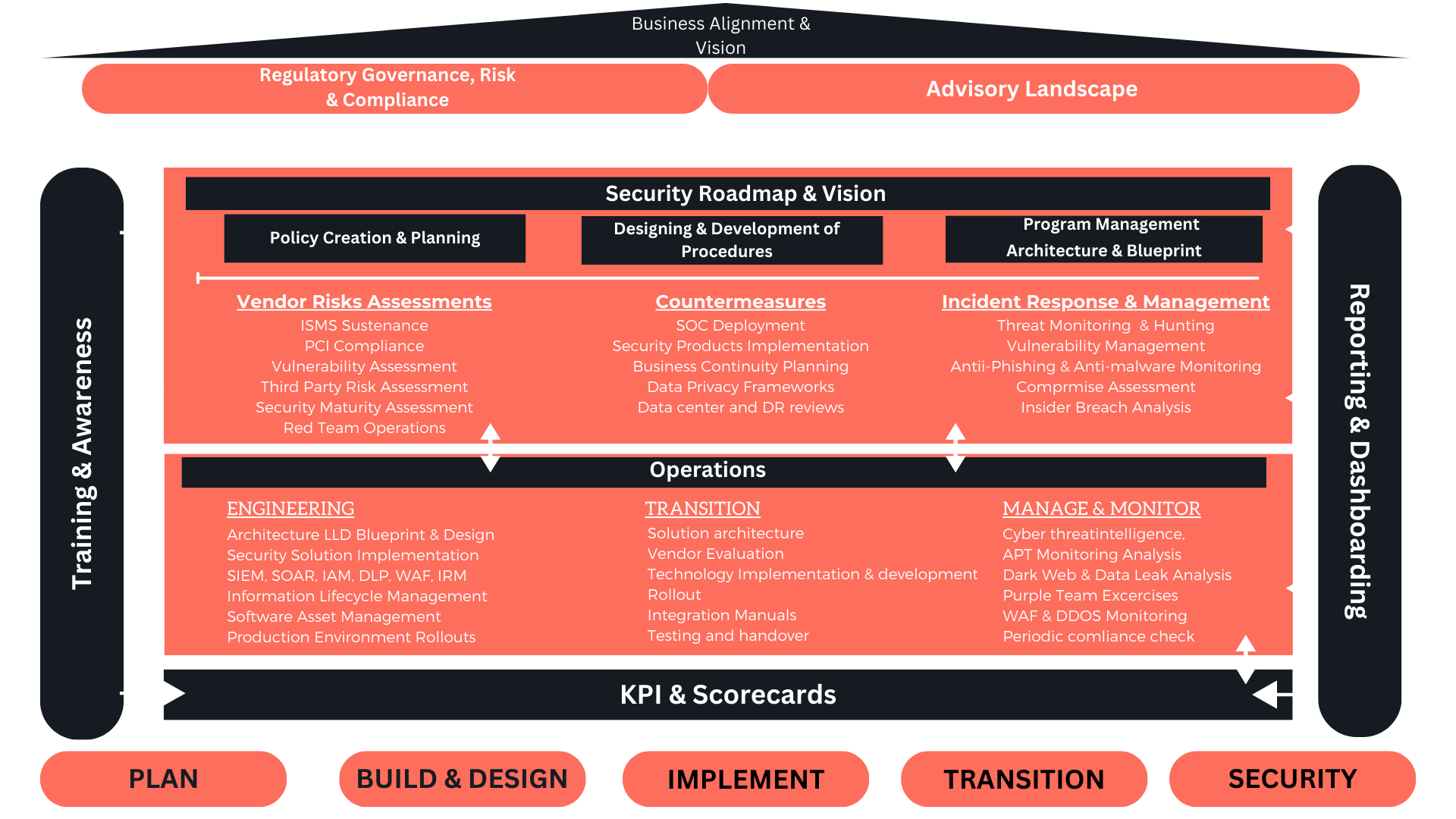

APPROACH TO BANKING TESTING METHODOLOGY

SECURITY CONSIDERATIONS

PCI DSS

Credit and debit card transactions are held to the standards set by the Payment Card Industry Data Security Standard (PCI DSS). For most banks, this forms the fundamental basis, necessitating their systems to align with regulatory mandates. Microminder serves as your reliable ally in ensuring comprehensive PCI DSS compliance.

GDPR

Every bank that manages the information of European individuals must adhere to the guidelines outlined in the General Data Protection Regulations (GDPR). Our team of cybersecurity specialists is proficient in guiding you through this intricate legislation, guaranteeing that your personnel comprehends the stipulations and implements all essential measures to safeguard your customers' data.

ISO 27001

CertCube Labs collaborates closely with your bank to verify that all systems fulfill the rigorous standards mandated by ISO 27001. This certification provides a robust assurance of elevated data security and alignment with the finest industry protocols.

SOX

The Sarbanes Oxley Act (SOX) delineates principles for sound business conduct and is obligatory for the majority of publicly traded firms. Microminder is committed to ensuring your financial institution complies with all the exacting mandates of SOX.

CertCube Labs Comprehensive Cybersecurity Services for Banks

CertCube Labs provides an extensive array of cybersecurity solutions designed to proactively guard banks against online threats. Our services encompass the identification of security vulnerabilities, the fortification of banking systems, and the implementation of highly effective cybersecurity measures. What sets us apart is our commitment to ongoing collaboration with clients throughout the cybersecurity journey, ensuring assistance is readily available when needed.

Allow us to take the reins of your cybersecurity to enhance the protection of your bank and its valued customers. Get in touch with CertCube Labs today to arrange a consultation. Your security is our priority.

Mobile Application Testing

In today’s digital age, if you’ve developed a banking app, your customers depend on it for their everyday financial needs. To ensure the safety and functionality of your app, we employ cutting-edge mobile testing tools and techniques. This rigorous assessment helps prevent potential financial losses stemming from cybercrime, safeguarding both your institution and your valued customers.

Penetration Testing

We offer penetration testing services to the industry, employing simulated real-life techniques to thoroughly assess the security of your applications and systems.

Firewall Security Assessment

Our thorough examination extends to your bank’s current firewall infrastructure, where we meticulously assess its performance and identify any necessary upgrades. This evaluation encompasses employee systems, devices, and the entirety of the bank’s external communications, ensuring comprehensive security enhancements.

Phishing Assessment

We take proactive steps to educate your bank’s staff and customers about the perils of phishing attacks. Our aim is to empower your institution with the knowledge needed to recognize and thwart such threats effectively. Additionally, we work collaboratively to establish a robust anti-phishing strategy to bolster your bank’s defenses against these deceptive tactics.

Cloud Security Solutions

CertCube Labs develops a security strategy for your cloud-based services and products, encompassing protective measures and business continuity plans.

Frequently Asked Questions

What is the importance of cybersecurity in the banking sector?

What are the most common types of cyber threats that banks face?

What is a Security Operations Center (SOC), and how does it contribute to banking cybersecurity?

Threat intelligence helps insurance companies stay informed about emerging threats and vulnerabilities, enabling them to proactively defend against cyberattacks.