Accounting Firms Cyber Security Services

Intelligence Driven Cyber Security Operations

Accounting Firms Cyber Security

Amid the pandemic’s threat to human lives, numerous industries, including accounting, have shifted to remote work, giving rise to a surge in cyberattacks. Accountants have become vulnerable to phishing, malware, password leaks, and SQL injection attacks. The accounting field, holding vast amounts of personal and financial information, has attracted cybercriminals seeking to exploit weaknesses. This data, including passwords, account numbers, and client details, becomes fodder for financial gain or blackmail once breached.Given the unpredictable nature of cyberattacks, a robust cybersecurity strategy is imperative. Enter CertCube Labs, a solution tailored to safeguarding accounting businesses.

Our cybersecurity services cater to accountants and CPAs across the UK, ensuring a fortified defense against hacks, scams, and data compromise.The pandemic-induced shift to remote work has compelled businesses, including those in accounting, to adapt swiftly. However, this transition has exposed them to a surge in cyber threats such as phishing, malware, and data breaches. Accounting firms hold a treasure trove of sensitive information, making them prime targets for cybercriminals. This includes not only financial data but also personal details of clients. These attacks can lead to severe financial losses and reputational damage.To counter these threats, CertCube Labs offers cutting-edge cybersecurity services, specifically tailored for accounting professionals. Our services provide comprehensive protection against a range of cyber threats, ensuring the integrity and security of your financial data.

The accounting industry, like many others, has experienced a paradigm shift due to the pandemic. Remote work has become the norm, but this change has brought about a concerning rise in cyber assaults. Accountants are increasingly falling victim to attacks like phishing, malware, and data breaches.Cybercriminals target accounting professionals due to the wealth of confidential information they possess, including passwords, financial records, and client data. Once accessed, this information can be exploited for financial gain or used to coerce victims.The unpredictable nature of cyber threats underscores the importance of a robust cybersecurity strategy.

CertCube Labs stands as a stalwart defender for accounting firms. Our tailored cybersecurity services empower accountants and CPAs throughout the UK to thwart cyber attacks, ensuring data security, client trust, and business continuity. The pandemic has reshaped how businesses, including accounting firms, operate. The shift to remote work has led to a surge in cyber threats like phishing, malware, and data breaches, leaving accountants vulnerable.Accountants and CPA firms are prime targets due to the valuable information they possess, from financial data to client details. These cyber attacks can have severe financial and reputational consequences.

In response to this growing issue, CertCube Labs offers specialized cybersecurity solutions designed to safeguard accounting professionals. Our comprehensive services provide proactive defense against a variety of cyber threats, ensuring the security and confidentiality of your financial data.

With CertCube Labs as your cybersecurity partner, you can put your accounting firm’s cyber defense concerns to rest. We handle all aspects of cybersecurity, from safeguarding your computer systems and networks to crafting a comprehensive cybersecurity strategy.

CertCube Labs has served both small and large accounting firms across the UK. Our cost-effective cybersecurity solutions are tailor-made to address the unique needs of your firm. Don’t hesitate to get in touch with us today to discover how we can prioritize cybersecurity for your accounting firm.

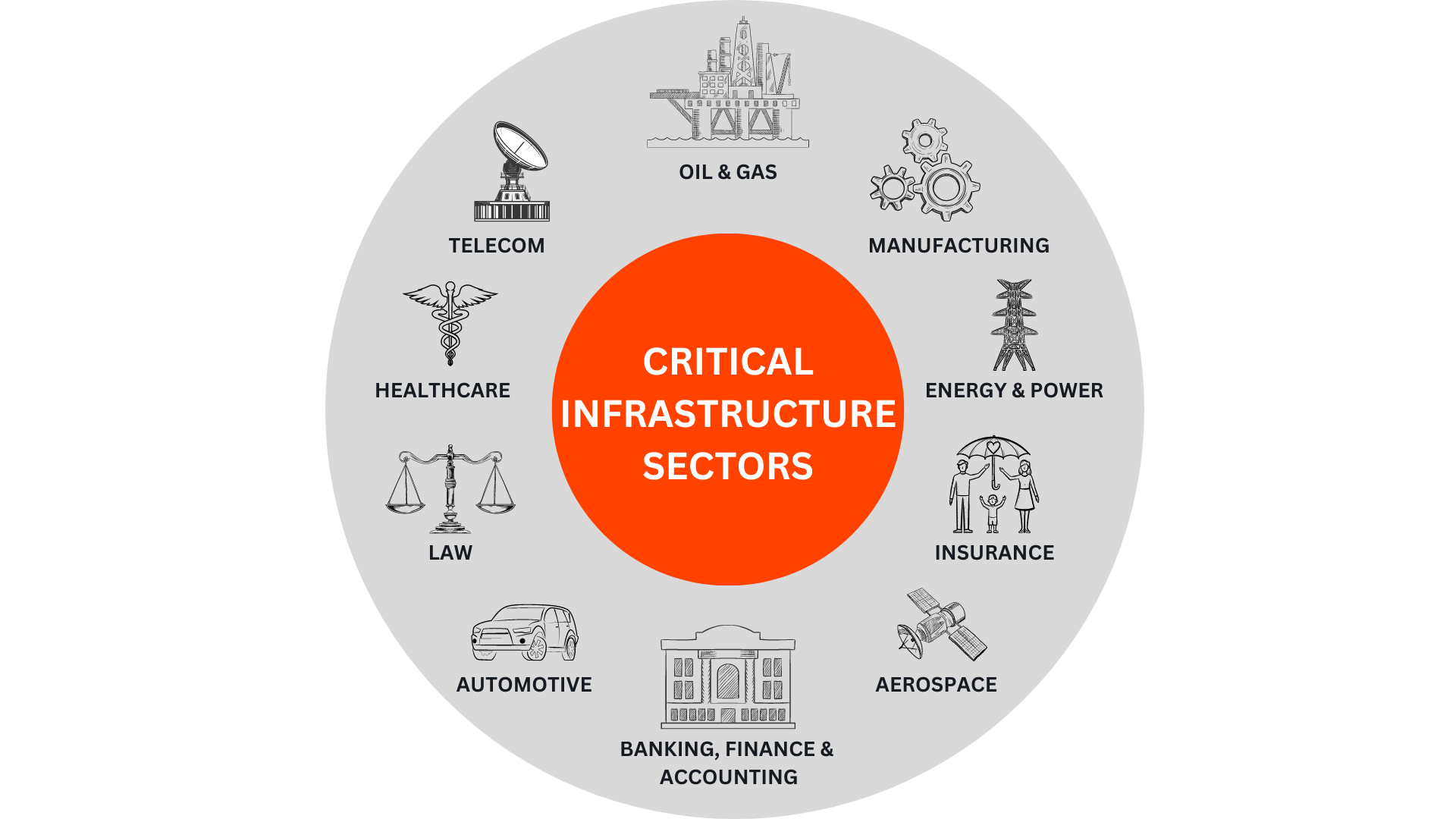

Cybersecurity threats are not discriminatory; they pose a risk to every business. Accountancy and finance teams, regardless of their size or sector, handle sensitive data, making them enticing targets for cybercriminals.It’s a common misconception that only larger organizations face cybersecurity attacks. In reality, smaller firms often attract cybercriminals due to perceived vulnerabilities.

It’s vital to avoid assuming that your accounting firm or your company’s financial data is immune to threats. Data breaches in the financial services industry, and beyond, are on the rise. In the realm of accounting, cybersecurity is of paramount importance. Accounting firms manage and store invaluable financial data and sensitive business information. Consequently, taking proactive steps to secure financial data is essential.

Here are key points emphasizing the urgency of proactive financial data security:

- Escalating Cyber Attacks: The number of cyberattacks continues to rise each year, with analysts predicting a 175% increase in stolen records by 2023 compared to 2018.

- Low Barrier for Hacking: Contrary to popular belief, many hackers do not require advanced technical skills. Simple methods like email phishing can be highly effective with minimal technical knowledge.

- Risk to Organizational and Client Data: A security breach can result in significant financial harm to your firm and expose clients’ data to theft, potentially leading to legal action against your firm.

- Long-lasting Reputation Damage: A data breach can erode trust and permanently damage your firm’s reputation. Recovery can be a lengthy process, as evidenced by the 2017 Equifax breach.

Clients entrust you with their financial records, and a breach can result in the theft of sensitive information or unauthorized changes to client files, impacting tax filing, stockholder reports, and other essential services. Losing your clients’ trust can be catastrophic.

Why Cybersecurity Matters in Accounting: Understanding the Consequences of a Cyberattack

Even if your accounting firm excels in its field, it is not immune to cyberattacks. Being a top-tier firm won’t shield you from a devastating hack, and instead of sympathy, you’ll likely face severe repercussions.

- Financial Loss: A single cyberattack can cost your firm at least $500,000, not including long-term financial effects or increased security expenses.

- Client Loss: When clients feel their financial information is at risk, they may leave your firm for competitors. In fact, 60% of small businesses close within six months of a data breach due in part to client attrition.

- Reputation Damage: Your reputation is your business’s core. A cybercrime can tarnish your brand, eroding trust in your ability to serve clients’ needs. Reputation damage may be the most enduring cost of a financial data breach.

- Reduced Employee Morale: A data breach affects both you and your employees, causing feelings of letting clients down and fostering worry about future breaches and blame.

No company emerges unscathed from a data breach, underscoring the critical importance of accounting cybersecurity.

Cybersecurity Threats to Financial Data

The list of cybersecurity threats is extensive, but many hacking techniques have been in use for years. Some have evolved into more sophisticated forms, while others persist due to complacency and inattentiveness among computer users. Among the most common threats are:

- Phishing: Phishing remains a prevalent and successful method for cyber thieves to steal financial data. A seemingly official email alerts you to a threat to one of your accounts, prompting you to provide account information to resolve the issue. However, the provided link doesn’t lead to a legitimate website but redirects you to the hacker’s site, where your personal information is exploited.

- Malware: Malware, in the form of malicious code or software, infiltrates your network through downloads, USB drives, and other means. This “silent” virus can corrupt operating systems, applications, and data before detection, easily spreading across your office’s computers.

- Ransomware: Ransomware stands among the costliest cyberattacks. Infected networks remain inaccessible until a ransom is paid, often in virtual currency like bitcoin. Cybercriminals retain encryption keys until their demands are met, but paying the ransom is risky, as there’s no guarantee of system release.

- Spam: Spam emails appear as legitimate advertisements for products or services. Clicking on links or downloading attachments can introduce viruses that freeze your system or steal your data.

Choose CertCube Labs to secure your accounting firm’s future and protect your valuable financial data.

Delegate cybersecurity to the experts and concentrate on your core expertise in accounting. Picture us as your dedicated security squad, equipped with cutting-edge technology to shield your business from online hazards. With Microminder, you can find serenity in the knowledge that your firm’s data remains secure, even as you rest.

We acknowledge that a significant portion of accounting tasks, such as tax filing, data entry, and invoice processing, occurs online. To shield your network from potential cyber threats, we institute a perimeter security solution that actively monitors and logs traffic activities.

Not everyone needs access to your company’s critical financial data. Certcube Labs enforces stringent access controls, permitting only authorized personnel to access relevant sections of your network. We assist in managing access levels and configuring permissions to minimize the risk of a security breach.

Many cyberattacks on accounting firms result from weak passwords and flawed authentication procedures. We specialize in crafting robust and distinct passwords for all users, whether it’s your CFO, bookkeepers, or advisors. Additionally, we offer comprehensive authentication solutions like two-factor authentication. This crucially prevents unauthorized individuals from gaining access to your financial data, even if they have valid credentials.

With CertCube Labs, we grasp the paramount importance of your data. Our backup and recovery solutions, designed specifically for accountants, ensure that your business can rapidly rebound, even in the face of unexpected challenges impacting your primary computer system.

CertCube Labs conducts ongoing security audits to provide you with peace of mind regarding your data’s safety. Our audits aim to pinpoint any vulnerabilities in your existing security protocols, propose potential enhancements, and deliver a comprehensive action plan for implementing these improvements.

With CertCube Labs, we regularly conduct security audits to ensure the safety of your data. Our audits are designed to detect any weaknesses in your current security measures, recommend possible enhancements, and furnish you with a structured action plan for implementing these changes.

Sarbanes Oxley Act (SOX)

In 2002, the United States introduced a law known as Sarbanes-Oxley Act, aimed at safeguarding investors against deceptive accounting practices within corporations. Following this precedent, a UK counterpart to this legislation is expected to be

PCI DSS

For CPA and accounting firms that process debit/credit card payments, adherence to PCI DSS is mandatory. At Microminder, we deeply understand the significance of PCI compliance and stand ready to assist you in fulfilling all the rigorous prerequisites of this standard.

GDPR

When managing the financial records of European Union citizens, compliance with GDPR is imperative. Our team of specialists is poised to support your accounting firm in meeting this EU regulation effectively.

Secure Your Accounting Firm with an All-Encompassing Cybersecurity Strategy

Experiencing a cyberattack isn’t just embarrassing; it can have severe consequences for your company. Moreover, cyberattacks aren’t exclusive to large corporations; even small businesses can become targets. Hence, it’s crucial to establish a cybersecurity strategy to shield your business from such incidents. Cybersecurity isn’t solely about preventing every attack it’s about preparing for and minimizing the impact when one does occur. Without cybersecurity safeguards in place.

This is where our CertCube Labs team steps in. Our cybersecurity experts boast extensive knowledge and can assist you in crafting a customized plan for your company. This cybersecurity strategy encompasses preventive measures and response protocols in the event of an attack. We understand the critical importance of uninterrupted business operations, and we’ll collaborate closely with you to ensure just that.

CertCube Labs offers an extensive array of Cybersecurity services tailored for Acounting firms.

CertCube Labs provides a comprehensive suite of cybersecurity services designed to address the unique needs and challenges faced by accounting firms. In an industry where data security, privacy, and regulatory compliance are paramount, our services are tailored to safeguard sensitive financial information and maintain the trust of clients.

CertCube Labs is committed to empowering accounting firms with robust cybersecurity solutions, helping them navigate the evolving threat landscape, protect sensitive financial data, and maintain the trust of their clients.

Phishing Assessment

We are here to assist you in making well-informed decisions regarding safeguarding yourself from online scams. Additionally, we offer valuable recommendations on the most effective ways to address and respond to any suspected phishing attempts, ensuring your online security is paramount.

Penetration Testing

We offer penetration testing services to the industry, employing simulated real-life techniques to thoroughly assess the security of your applications and systems.

Firewall Security Assessment

Ensuring the security of your accounting firm against online threats is of paramount importance. We are dedicated to helping you reinforce your firewall defenses, offering expert guidance and recommendations on the most effective strategies to secure your network from cyberattacks. Your cybersecurity is our priority.

Third-Party Risk Assessment

Our team of experts is capable of conducting an extensive risk assessment to evaluate the security status of your business partnerships and associations.

Email Security Solutions

Email continues to be a prime avenue through which cybercriminals target accounting firms. Microminder provides an array of robust security solutions designed to shield your email inbox from a spectrum of threats, including spam, phishing attempts, and malicious attachments. Your email security is a critical component of safeguarding your accounting firm’s sensitive information and operations.

Incident Response Planning

In the event of a security incident, we assist accounting firms in developing and testing incident response plans to minimize disruption and data loss.

Frequently Asked Questions

How does CertCube Labs assist accounting firms in enhancing their cybersecurity posture?

What specific security controls does CertCube Labs recommend to protect sensitive financial data and client information for accounting firms?

Can CertCube Labs help accounting firms meet compliance requirements such as GDPR, HIPAA, or industry-specific standards like the AICPA SOC 2?

What is our approach to securing remote work environments for accounting professionals, especially given the shift to remote work in recent times?

How does CertCube Labs assist accounting firms in securing their communication channels, such as email and file sharing, to prevent data leakage and unauthorized access?

How can insurance companies ensure third-party vendors maintain adequate cybersecurity standards?

Insurance companies should conduct thorough security assessments of third-party vendors, require them to adhere to cybersecurity standards, and include security clauses in contracts.